The Smartest Way to Handle Real Estate Tax Services to Maximize Savings

The Smartest Way to Handle Real Estate Tax Services to Maximize Savings

Blog Article

Comprehending the Importance of Building Accounting in the Building & Property Industry

In the building and construction and real estate sector, the significance of building audit can not be overstated; it works as a cornerstone for accomplishing economic success and functional efficiency. By utilizing thorough job expense monitoring and strategic money circulation monitoring, firms can deal with the one-of-a-kind obstacles positioned by complicated tasks. Additionally, the capability to keep openness and ensure regulatory compliance plays a critical role in fostering integrity and affordable advantage. Yet, despite its significance, numerous companies ignore essential practices that might improve their economic efficiency. Checking out these nuances exposes important understandings that can reshape how industry players approach their financial monitoring approaches.

Key Concepts of Building And Construction Bookkeeping

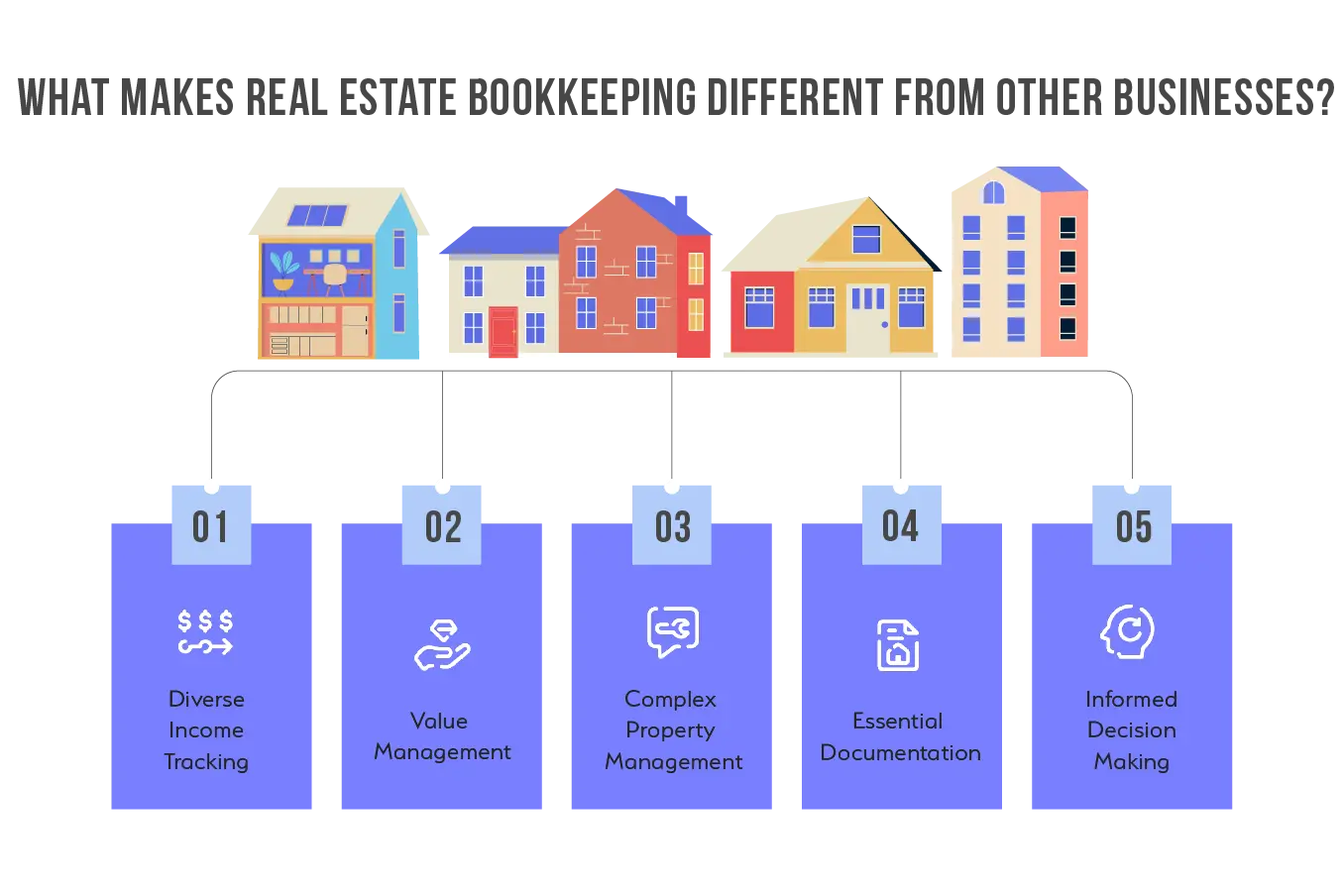

Understanding the one-of-a-kind monetary landscape of the construction sector requires a strong grasp of key concepts of construction accountancy. Real Estate Accountants. At its core, building accounting varies significantly from typical bookkeeping practices due to the complexities integral in project-based operations. One basic principle is task setting you back, which involves tracking all expenditures related to private tasks. This allows contractors to evaluate productivity accurately and handle budgets efficiently.

One more essential concept is using progress invoicing, which enables specialists to obtain settlements based upon the percentage of work completed. This method helps maintain cash flow throughout the project duration, vital for functional security. In addition, understanding income recognition is vital; the percentage-of-completion approach is usually made use of to straighten profits with task landmarks, mirroring the task's economic reality.

Furthermore, building accounting emphasizes the significance of precise forecasting and budgeting, as jobs usually cross a number of months or years. Efficient project management tools and software can aid in keeping an eye on economic efficiency, making sure that all stakeholders have exposure into the project's monetary health and wellness. Grasping these principles outfits construction firms to browse their one-of-a-kind financial challenges and maximize their operational effectiveness.

Obstacles Special to Building Projects

What difficulties do building tasks deal with that set them in addition to other sectors? One considerable challenge is the inherent intricacy of construction tasks, which typically involve several stakeholders, consisting of specialists, customers, suppliers, and subcontractors. Each celebration might have different top priorities and timelines, resulting in control difficulties that can affect task delivery.

In addition, construction jobs are susceptible to changes in product costs and labor accessibility, which can interfere with timetables and budgets. Climate conditions likewise present a distinct difficulty, as unforeseen delays can cause increased prices and extended timelines. Regulatory compliance and permitting procedures vary by region, adding an additional layer of intricacy that must be browsed carefully.

Another distinct difficulty is the project lifecycle, defined by stages such as design, bargain, building and construction, and purchase. Each stage requires meticulous planning and financial tracking to make sure resource allowance lines up with job goals. The potential for change orders and scope alterations even more complicates monetary administration, demanding durable accounting practices to maintain profitability.

Lastly, the market often comes to grips with capital issues, as settlements are commonly contingent upon project landmarks. This can stress funds, making effective building and construction bookkeeping critical to overcoming these difficulties.

Advantages of Accurate Financial Tracking

Accurate monetary tracking offers as a keystone for successful building job management, particularly taking into account the special difficulties dealt with by the industry. By maintaining specific monetary records, building and construction firms can improve decision-making processes, permitting managers to allocate sources effectively and respond promptly to monetary restraints.

One of the vital benefits of accurate economic monitoring is enhanced capital administration. Knowing when money schedules from clients and when settlements to vendors are required aids avoid cash money lacks, ensuring tasks remain on schedule. It makes it possible for firms to recognize discrepancies early, alleviating the risk of budget plan overruns.

In addition, accurate monetary information facilitates efficient task forecasting. By evaluating previous financial performance, business can make enlightened quotes for future jobs, reducing the possibility of unanticipated prices. This foresight likewise helps in developing affordable proposals, as firms can supply even more accurate pricing to clients.

Last but not least, exact economic monitoring boosts conformity with legal responsibilities and regulative requirements. By systematically documenting revenues and expenses, building and construction companies can conveniently create needed reports for audits, protecting themselves versus prospective lawful disputes. In summary, accurate economic monitoring is crucial for promoting monetary stability and advertising lasting success in the building and construction market.

Necessary Devices and Software Program

Just how see this here can building and construction firms properly handle their economic data in a progressively complex landscape? The answer depends on leveraging important tools and software customized to the one-of-a-kind demands of the building and construction and realty market. Building and construction accountancy software application offers robust solutions for monitoring expenditures, handling budget plans, and generating economic records. By using devoted platforms, firms can enhance their bookkeeping processes and make certain conformity with industry policies.

Popular building audit devices, such as Sage 300 Building And Construction and Genuine Estate, Viewpoint View, and copyright Service provider, offer attributes that help with project-based audit. These systems allow real-time monitoring of task prices, payroll handling, and invoicing, permitting higher economic exposure and control. In addition, cloud-based services supply the advantage of remote gain access to, ensuring that stakeholders can work together properly despite their place.

Incorporating project administration software program with bookkeeping devices further improves functional performance. This integration permits smooth information sharing, decreasing the probability of mistakes and improving decision-making. Eventually, choosing the right combination of necessary devices and software application is essential for construction business intending to maximize their economic management and sustain growth in an open market.

Ideal Practices for Building And Construction Accounting

Efficient economic management in building audit pivots on the implementation of best methods that promote precision and openness. One core concept is the utilization of specific building and construction bookkeeping software program, which improves processes such as work, billing, and payroll costing. This modern technology not only lessens mistakes yet additionally boosts reporting capacities.

Another necessary method is preserving careful paperwork. Keeping thorough documents of contracts, change orders, and billings makes certain that all purchases are deducible and verifiable. When disagreements arise., this level of documents is particularly crucial throughout audits or.

Routine financial testimonials and settlements additionally contribute substantially to efficient construction accounting. By regularly contrasting real costs to allocated amounts, firms can determine variations promptly and readjust their approaches appropriately. Developing a clear chart of accounts customized to the certain needs of the building and construction market more aids in that site arranging financial information, enabling even more insightful evaluation.

Conclusion

In final thought, building accounting functions as an essential part in the building and construction and property market, facilitating efficient monetary monitoring and project success. By adhering to crucial concepts and employing vital devices, companies can browse the distinct difficulties of building and construction tasks while reaping the benefits of precise monetary monitoring. Applying ideal practices not only enhances success and capital monitoring yet additionally ensures compliance with regulatory requirements, eventually promoting lasting development within a competitive landscape.

In the building and construction and check over here actual estate sector, the significance of construction accountancy can not be overstated; it serves as a foundation for accomplishing financial success and operational efficiency.Understanding the unique financial landscape of the construction industry calls for a strong grasp of essential principles of construction accounting. In summary, exact economic monitoring is necessary for promoting economic security and advertising long-lasting success in the building and construction market.

Report this page